Answer: It depends. And the personal finance app CalendarBudget can help you decide.

If you have extra money, reducing your debt is a great idea for several reasons.

- You never know if interest rates will go up and thus your mortgage payments may become unmanageable.

- Having no debt is one of the nicest, freest feelings available. You will be much happier.

There are several ways to do this.

- just add lump payments when you have enough extra money. Usually, your bank will limit the amount you can add on or the number of extra lump payments. If you don’t have internet banking with a mortgage at the same institution as your regular bank account, this can be a little tedious.

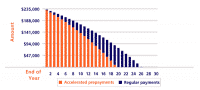

- Go to your mortgage provider and have them re-amortize the mortgage for you. Scotiabank, for example, does this for free. After talking with my mortgage person, explaining how much I thought I could pay biweekly, I changed my mortgage from its original 25-year term to 9 years. That resulted in me paying an extra $170 biweekly. Now, this amount automatically comes out of my bank account and I’m on track to be debt-free much sooner. Since I’m paying it off much faster, I’m depriving “interest” the time it wants to grow and putting that wasted money back into my pocket, where it belongs! Also, I’ve committed to this amount, so it’s not possible for me to simply spend this “extra” money on other things. This is my preferred and recommended way to increase your mortgage payments.

However, there are some downsides to it. Assuming interest rates don’t change wildly, if you put your extra money into a tax-sheltered savings-investment you’ll probably earn a better interest rate on your investment than the interest rate you are paying for your mortgage. Also, if you have any other debts (credit cards, loans, etc) they are probably at a higher interest rate than your mortgage. You should ALWAYS pay off the higher interest rate debt first. Even though the mortgage is likely a much higher amount, its the interest rate that should determine which order you pay things off [see the previous blog on debt elimination calendar].

In the end, it comes down to interest rates and risk. If the interest rate for your savings is predicted to be higher than your mortgage rate, it’s better in the long run to save your money. Also, consider how you feel about having debt. If you are like me, you want it all gone and paying down all debts, including mortgage, takes a high priority. In my case, I’ve set up my budget with the CalendarBudget personal finance app to blend my savings by paying down the mortgage. Even though I can get a better interest rate in savings, my risk tolerance is not very high for big debt. I’m always nervous that the interest rate will go up to a crazy number like 18% as they did in the 80s.

The CalendarBudget online budget tool can show you how this will affect your finances as you plan for something like this. Whenever I am making a change to my finances that will affect my recurring expenses, CalendarBudget is the personal finance app that shows me the way! Give it a try!

Leave A Comment