If you’re looking for a better way to manage your budget, you should try using a budget calendar. A budget calendar is simply your budget tracked and planned on a calendar. The calendar layout makes it easy to understand and connect well with how your money flows. Working with your budget online allows you to easily keep your budget up to date in minutes and the ability to look forward months and years ahead to know how today’s purchases will affect your future finances. It’s a great way to keep track of your spending and make sure you stay on track each month. Here’s why calendar budgeting works so well and how you can get started using an online budget system.

What is a budget calendar?

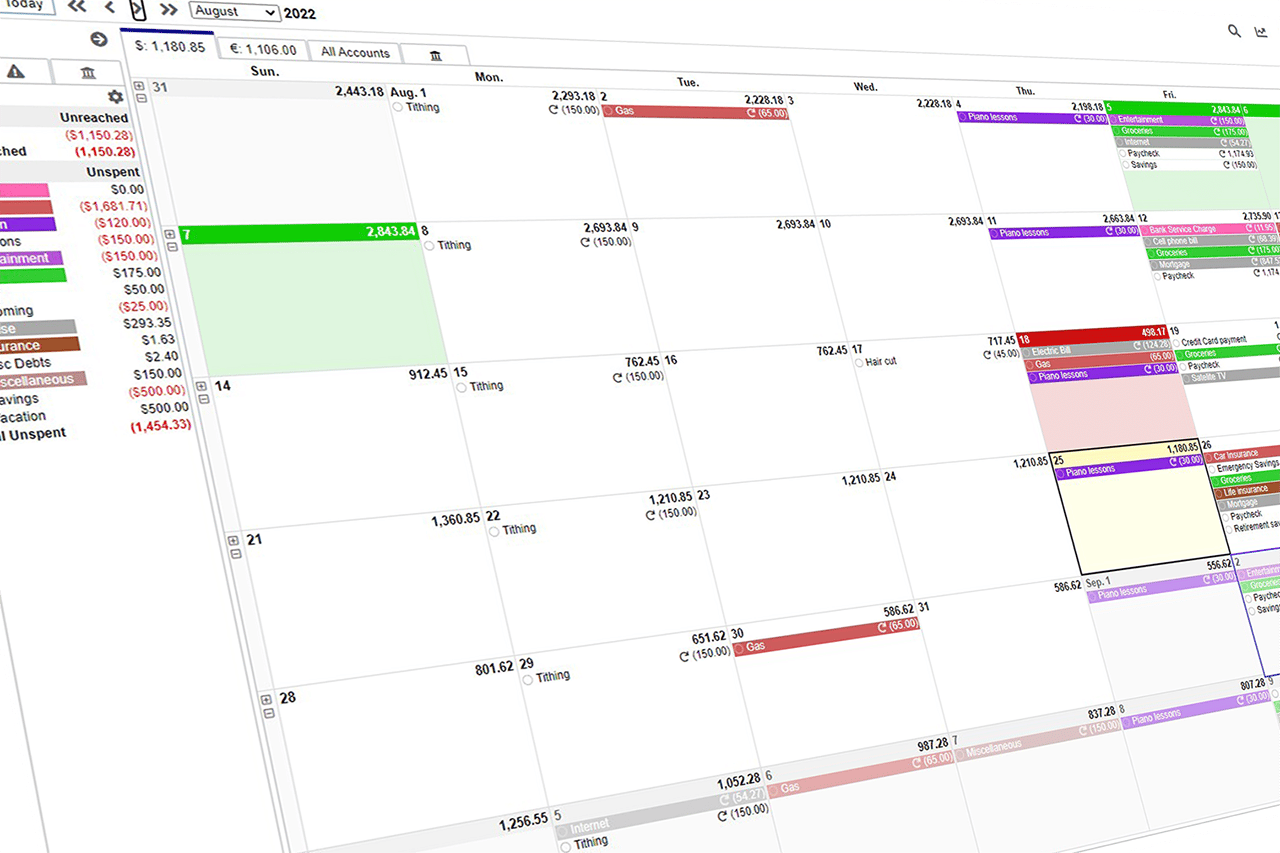

A budget calendar is an online budgeting tool that allows you to plan your budget and track your spending on a calendar layout. You can use a budget calendar to set up a monthly budget, track your expenses, and see where you need to cut back on spending.

Why Calendar Budgeting Works so Well

There are many reasons why calendar budgeting works so well. Here are some of the top reasons:

It’s Clutter-Free

When you use a budget calendar, you can get rid of all the paper clutter that comes with traditional budgeting methods. You won’t have to keep track of receipts or write down your expenses in a notebook. Everything is online, so you can access it from anywhere. The calendar layout also helps you to visualize when transactions happen as we tend to plan and view our life in chunks by days and weeks. This helps you to declutter your mind from struggling to juggle transactions from the week against each of your account balances. No more forgetting payments or guessing what should be in your account each month.

You Can Share It

If you’re working on a budget with your spouse or partner, you can share your budget calendar online. This way, both of you will have access to the same information and can see where you need to make adjustments. As you make changes to your budget in CalendarBudget, you can instantly see those updates across all of your devices so you can stay on the same page with your finances.

More Accurate Forecasting

Calendar budgeting helps you get a more accurate picture of your spending patterns. When you can see where your money is going each month, you can make better decisions about how to save money. As you compare your calendared transactions to your daily life, you can see how they affect each other. Maybe on Fridays you see that you tend to order dinner each week. When compared with your daily activities, you find that by the time Friday comes along you feel that it’s been a long week and don’t want to cook so end up with the order in expense you didn’t intend. With a little meal planning, you can prepare food ahead of time or find easy meals to make Friday’s dinners fun food from home, thus saving more money in your pocket.

It Works the Way Our Brains Work

Calendar budgeting works with the way our brains are wired. Studies have shown that we’re more likely to remember things when they’re written down in a calendar format. We make plans by specific dates and even more so by days of the week. So, by using a budget calendar, you’re more likely to stick to your budget because you can connect with it and understand your money flow.

Easier to Save Money

Calendar budgeting can help you save money. When you know where your money is going, you can make adjustments to your spending and put more money into savings, or pay down debt faster. You can identify some unnecessary repeat expenses, like grabbing breakfast or your special morning beverage on your way to work every morning. Your budget calendar will help you see the repeat expenses, identify how much it costs you each month, and see the benefits in your future finances if you were to eliminate that expense by using what you have at home.

Planning for Larger Purchases

If you’re planning a large purchase, like a new car or a vacation, calendar budgeting can help you save up for it. You can create a savings plan and see how much you need to save each month to reach your goal. In CalendarBudget you can look forward to your daily balances to see when exactly you can afford your purchase. You can also find expenses to reduce or eliminate in order to get there sooner.

Start to Plan Your Budget Online with a Free Trial From CalendarBudget

If you’re ready to get started with calendar budgeting, CalendarBudget offers a 30-day free trial so you can try it out. With CalendarBudget, you can create a monthly budget plan, track your expenses to see how they affect your plan, and see where you need to cut back on spending to keep your finances in check.

Sign up for your free trial today and get an online budget system that works!

Leave A Comment